Closely followed crypto analyst Justin Bennett says that both the stock and digital asset markets, including Bitcoin, are on the verge of another sell-off event.

Bennett tells his 101,000 Twitter followers that he has his eye on the total market cap of all crypto assets (TOTAL), which he says looks ready to break through its diagonal support.

“Everything is either breaking support or looks ready to.

TOTAL with a small fakeout above $940 billion. Now weighing on channel support.

I doubt this holds much longer.”

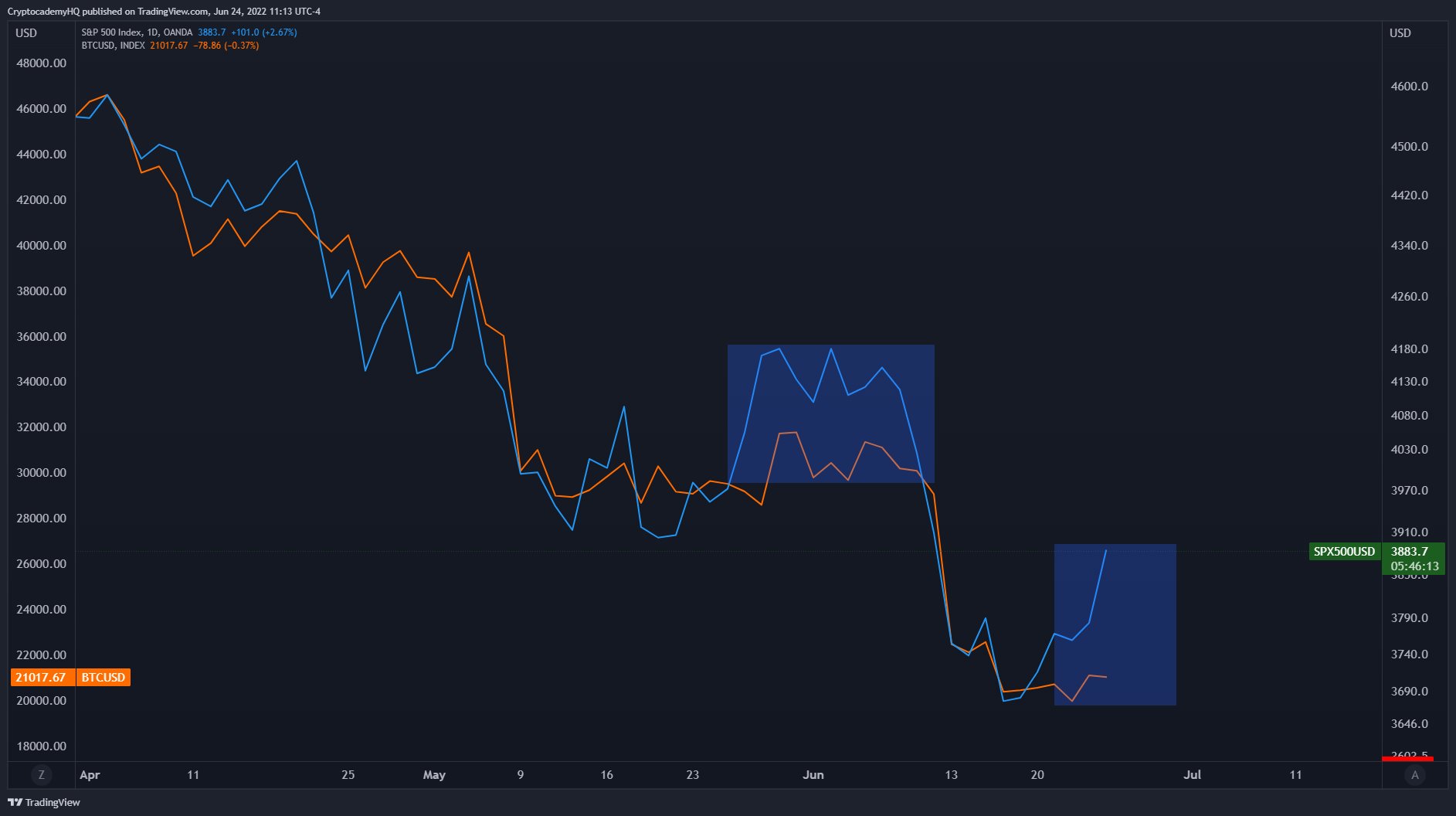

The analyst says that while the S&P 500 had a strong finish on Friday, he warns that the resumption of the downtrend is in sight. He shares a chart to illustrate how both the stock market and Bitcoin bounced in late May to early June only to erase their gains in a matter of days.

“Nice move from the S&P 500 today, but crypto is asleep.

Things got ugly the last time this happened.

Be careful out there.

S&P 500 in blue, BTC in orange.”

While Bennett is expecting another leg down to new lows for crypto in general, there are some in the space who believe the bottom is very close for Bitcoin.

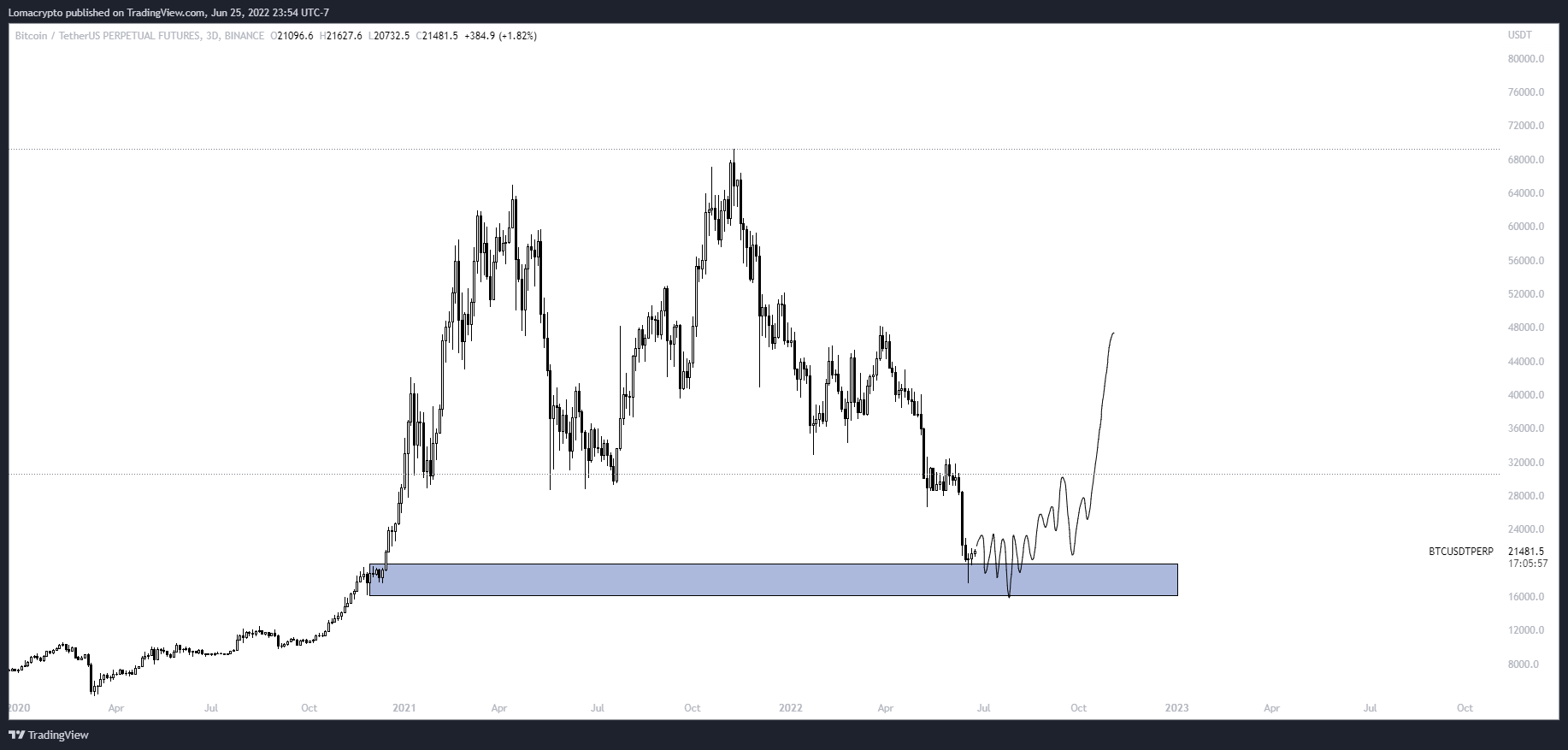

Pseudonymous trader Loma tells his 273,000 Twitter followers that he’s expecting Bitcoin to enter an accumulation phase before reversing upward quicker than most expect.

“Assuming price has bottomed (local bottom but I don’t know about macro):

· We probably get an accumulation period, that’ll be somewhat faster than usual

· I’m more or less focused on grabbing swing positions early on into a trend and praying to Satoshi that I don’t sell too early.”

At time of writing, BTC is trading for $21,206.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Alberto Andrei Rosu/Natalia Siiatovskaia