A widely followed crypto strategist says one crucial metric can help accurately call Bitcoin (BTC) market bottoms.

Pseudonymous trader Rekt Capital tells his 311,400 Twitter followers that BTC’s Relative Strength Index (RSI) is mirroring levels reached in January 2015, December 2018 and March 2020, signaling a bounce might be on the horizon for the top crypto asset by market cap.

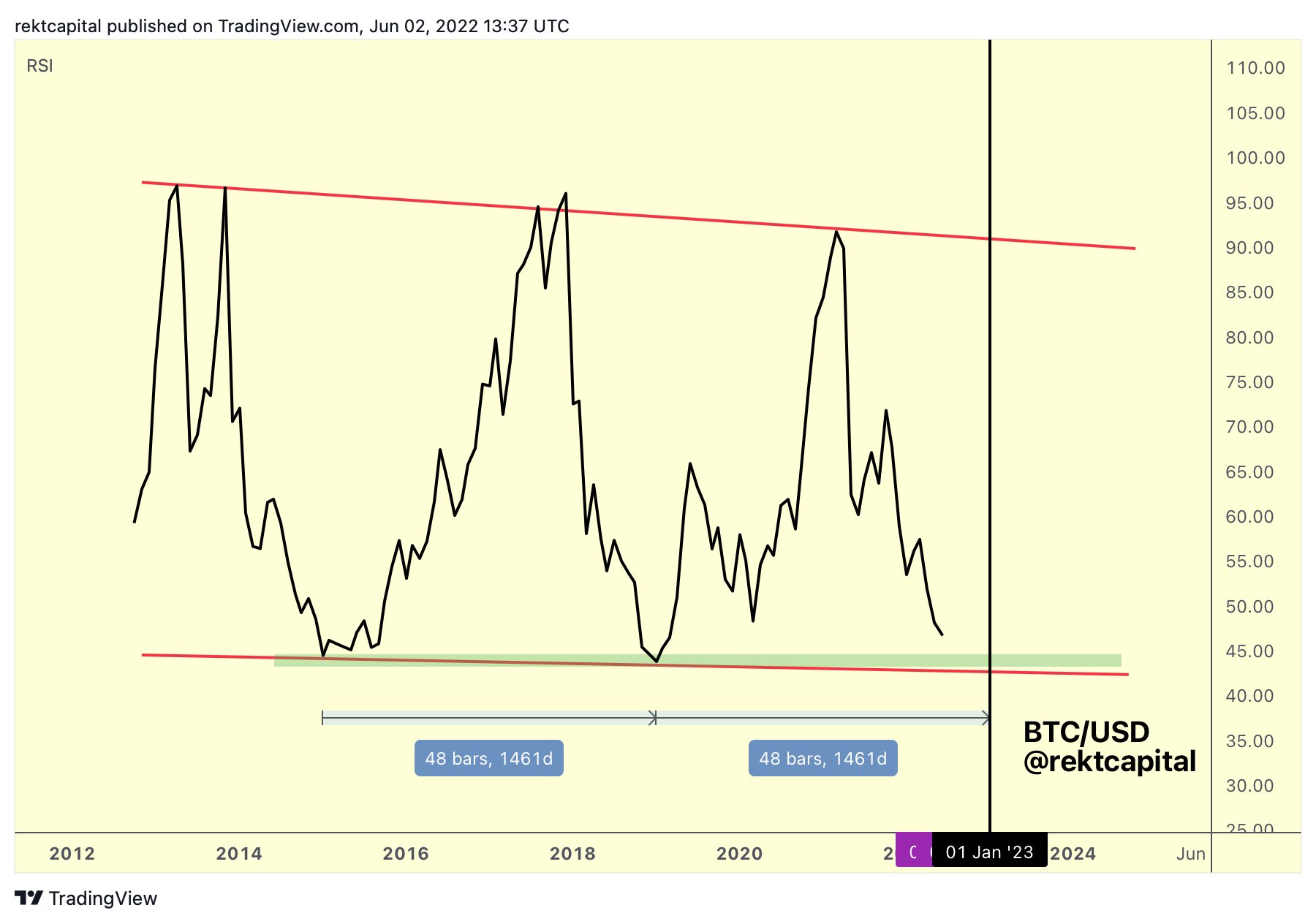

“BTC is approaching the RSI Bear Market Bottom area once again. When could it take place in this cycle?

It took 1,461 days for the 2018 Bear Market Bottom to form after the 2015 BMB.

If the same symmetry repeats, the upcoming BMB will occur in January 2023.”

An asset’s RSI is a momentum indicator measuring recent prices to determine whether it is oversold or overbought in a specific timeframe.

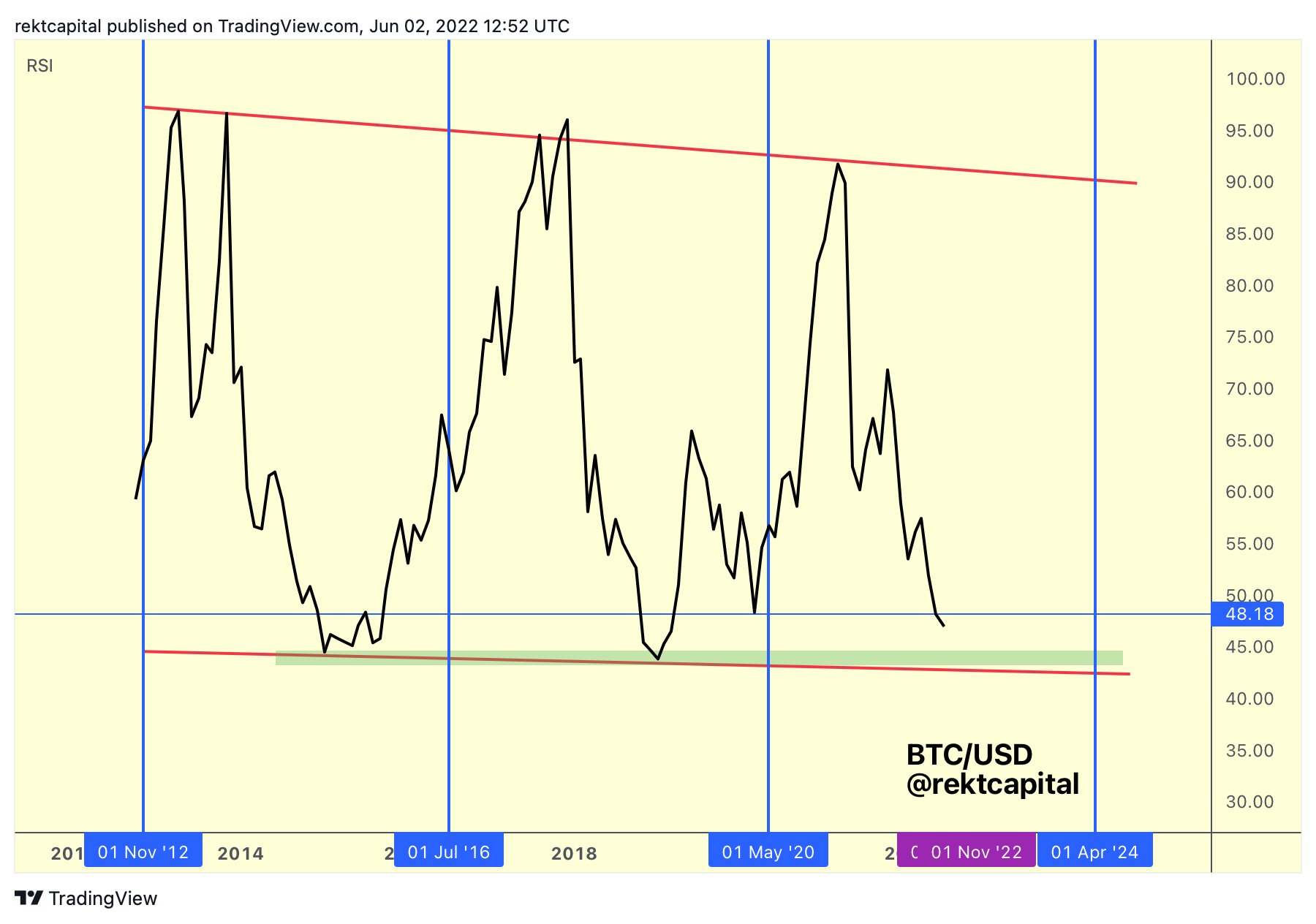

The trader next presents a scenario where the bear market bottom arrives two months earlier in November and cites Bitcoin’s halving which happens every four years as the reason.

“There is a chance that the BTC RSI Bear Market Bottom takes place a little sooner than January 2023.

And this would be due to the Bitcoin halving [next in 2024].”

Rekt Capital lays out an “if past is prologue” scenario where the BMB does in fact occur this autumn.

“BTC bottomed in 2015 approximately 547 days before the 2nd halving.

BTC bottomed in 2018 approximately 486 days before the 3rd halving.

If BTC bottoms 487 or 548 days before the 4th halving in April 2024, then that bottom would take place in October or November 2022.”

The trader concludes by saying the RSI data indicates that Bitcoin is oversold, meaning that those who bought in during the months-long bear market are likely to be rewarded during the next cycle.

“It’s clear that BTC is entering oversold RSI conditions.

Historically, long-term BTC investors who’d accumulated in these conditions have benefited from high return on investment [ROI] in the many months that followed.”

Bitcoin is currently down 2.81% on the day, trading for $29,626.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/IfH/Sensvector