A prominent crypto analyst says that leading digital asset Bitcoin (BTC) will spark an immense rally once it goes above a key price area.

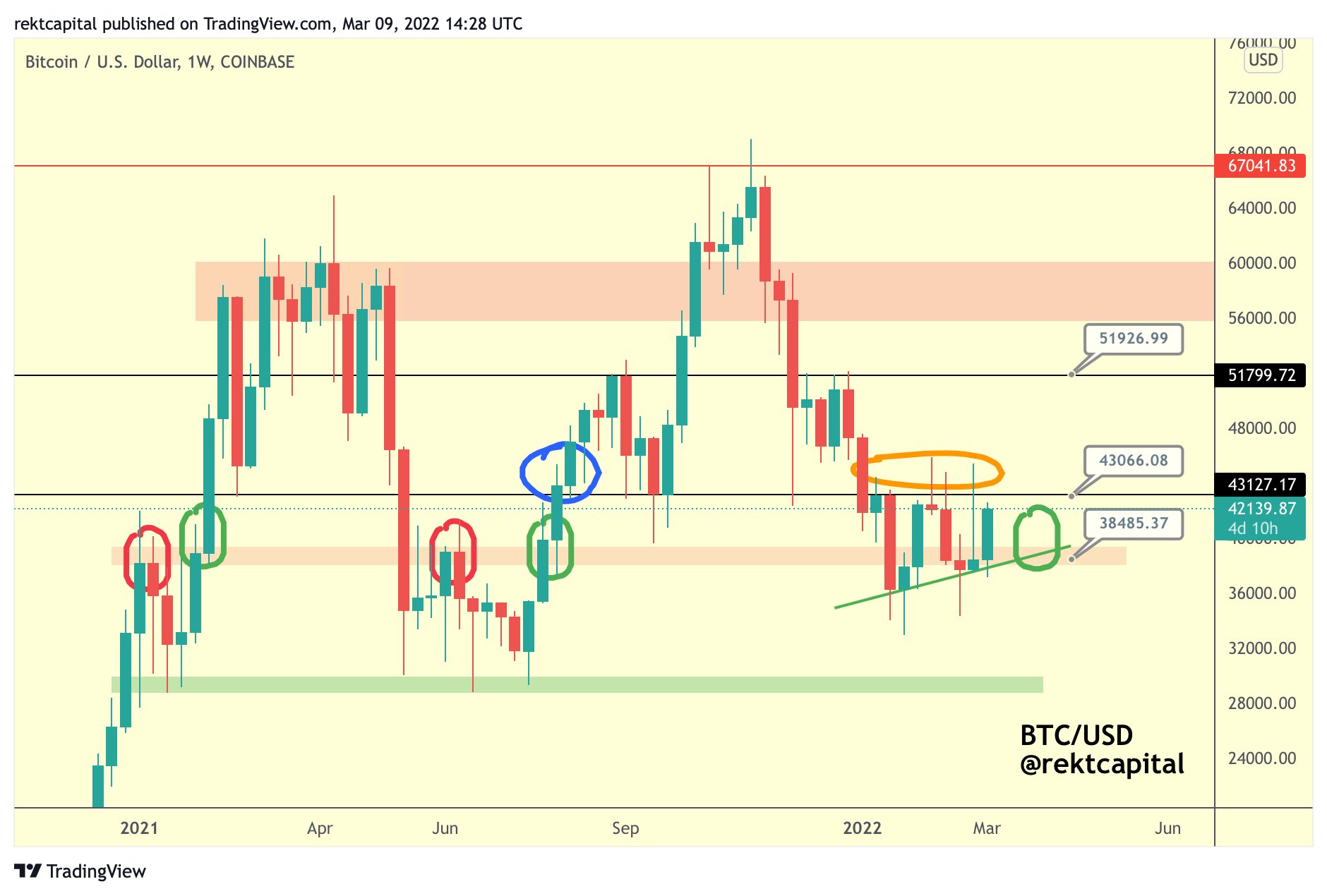

Pseudonymous trader Rekt Capital tells his 292,000 Twitter followers that the top crypto asset by market cap is set to break out once it crosses the $43,000 mark.

“The most important BTC EMAs [exponential moving averages] and MAs [moving averages] that have historically dictated breakouts are suggesting that the ~$43,100 level is [the] one to break for immense upside.”

The analyst notes that the last time BTC shot past the $43,000 price tag while continuing to maintain its upward momentum, it led to a surge that pushed Bitcoin to its all-time high set in November 2021.

“BTC has performed upside wicks beyond the $43,100 resistance on a few occasions over the past few weeks.

Which is why it’s important that BTC performs a weekly close above this level, just like [previously] in August 2021.”

The strategist then says that some of Bitcoin’s technical indicators are coming together to signal that BTC could soon see upwards price action.

“Not only is BTC forming a higher low on its price on the weekly timeframe, but it is also forming a higher low on indicators like the RSI [Relative Strength Index] or the MACD [moving average convergence/divergence].

Promising confluence.”

Bitcoin is exchanging hands at $39,237 at time of writing, a 6.5% decrease during the last 24 hours but a 5% increase from its seven-day low of $37,387.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/mim.girl