A closely followed crypto strategist is warning Bitcoin (BTC) holders, saying the king crypto’s recent price action is reminiscent of the time that preceded its collapse in 2018.

Pseudonymous analyst Rager tells his 204,300 Twitter followers that while Bitcoin continues to hold support around $19,000, the demand area is now starting to show signs of exhaustion.

According to the crypto analyst, sellers have been out in force every time Bitcoin attempts to rally above $19,000.

“Never a fan of the bouncing ball pattern with rallies. It never ends well.

Hoping that the stock market can pull Bitcoin back up. Otherwise, well, you know.”

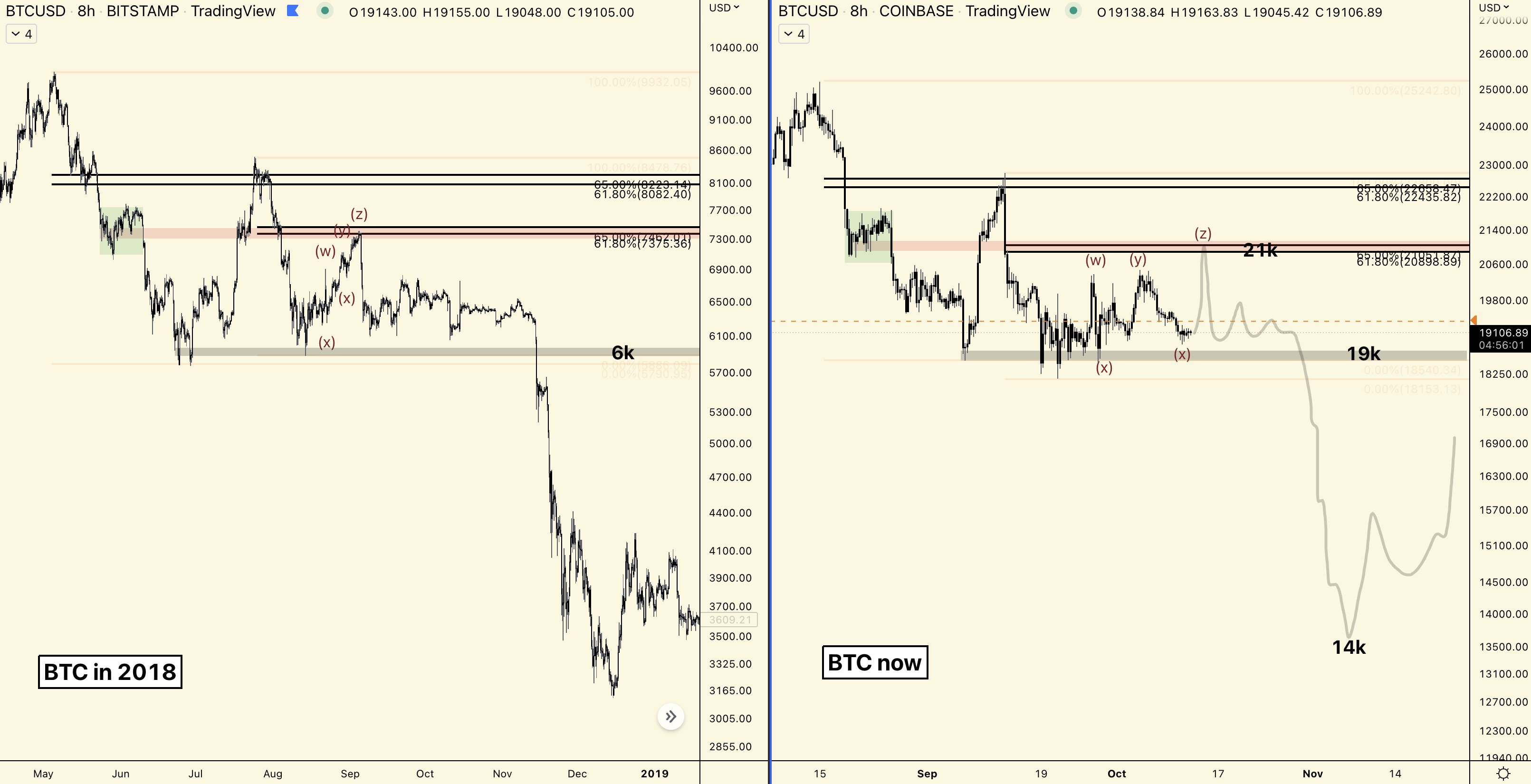

Rager is also noticing the lack of volatility in Bitcoin, which he says reminds him of what happened in the weeks leading up to the meltdown of BTC from $6,000 to around $3,000 in 2018.

“BTC weekly closed with a candle body less than $200 range. Bitcoin moving sideways and compressing = boring. [The] last few weeks reminds me of September 2018 right before the market went violent and nuked. Chart below of 2018.”

Fellow crypto analyst Capo also has a similar sentiment. According to the trader who nailed BTC’s crash this year, Bitcoin’s current price action is mirroring its market structure during the height of the 2018 bear market.

Although Capo believes that support at $19,000 will eventually give out, he doesn’t see Bitcoin suffering another 50% devaluation just like it did in 2018.

“There are a lot of people posting this 2018 fractal these days. However, they think price should keep making lower highs and then dump 50% like in 2018, and they are ignoring the fact that fractals indicate major direction, but not low timeframe price action nor [breakdown] percentage.”

According to the analyst, BTC will likely rally to $21,000 first before breaching support at $19,000 and bottoming out at $14,000.

At time of writing, Bitcoin is swapping hands for $19,542, up nearly 2% on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Lumitar