A trading robot with a reputation for outperforming the digital asset markets is sharing its newest portfolio allocations amid the ongoing crypto winter.

Every week, the Real Vision Bot conducts surveys to compile algorithmic portfolio assessments that generate a “hive mind” consensus.

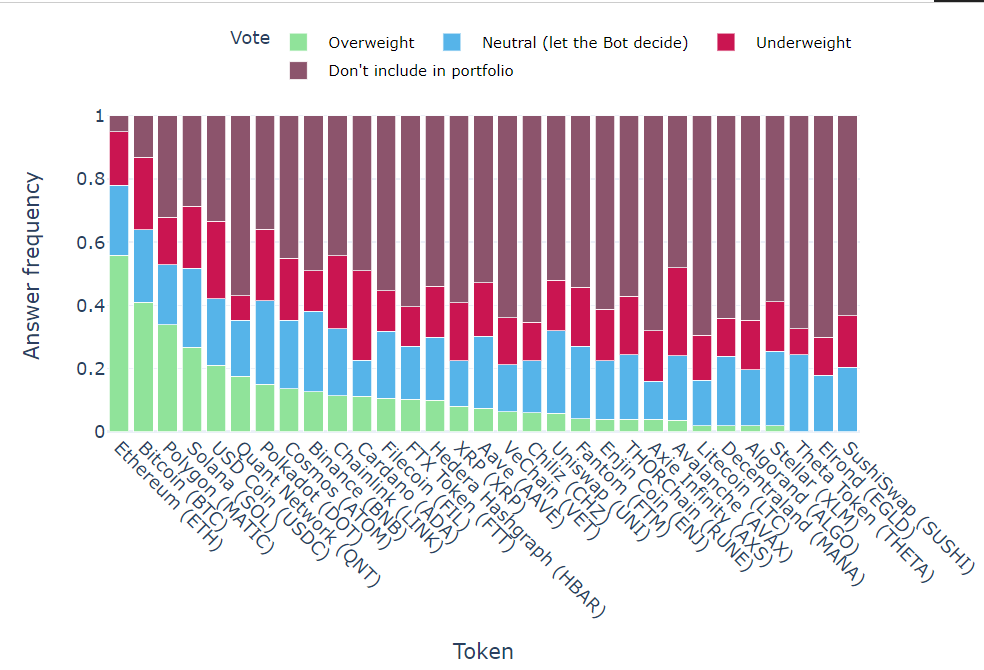

The bot’s latest data reveals that traders’ have a strong preference for Ethereum (ETH), with the majority of market participants (nearly 56%) voting to overweight their portfolios with ETH. Second place is Bitcoin (BTC), with a nearly 41% allocation.

ETH layer-2 solution Polygon (MATIC) came in third with a nearly 34% allocation, followed by layer-1 smart contract platform Solana (SOL) with a 26.7% allocation. Rounding out the survey’s top five is the Circle-issued, dollar-pegged stablecoin US Dollar Coin (USDC) with a 21% allocation.

The Real Vision Bot was co-developed by quant analyst Moritz Seibert and statistician Moritz Heiden.

Real Vision founder and macro guru Raoul Pal has called the bot’s historic performance “astonishing.” The former Goldman Sachs executive says the bot outperforms an aggregated bucket of top 20 crypto assets on the market by more than 20%.

ETH is trading at $1,305 at time of writing. The second-ranked crypto asset by market cap is down almost 2% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Plastic Man/pikepicture