- Ethereum would be introducing Protco Danksharding in the coming months.

- The amount of revenue generated by ETH validators decreased by 26% in the past month.

The broader market has undoubtedly been reeling under the selling pressure. But, according to the roadmap presented by the Ethereum Foundation, the near future looks very interesting for the ETH holders. Well, thanks to multiple updates and developments that will be executed on the network in the coming year.

Read Ethereum’s Price Prediction 2023-2024

Hit the road(map)

One of the major updates on the Ethereum network would be the introduction of withdrawals.

Well, withdrawals for the majority of stakeholders would be launched by the end of March while testing would begin in January and February.

The talk about enabling withdrawals has led to some FUD (fear, uncertainty, and doubt). Many users are concerned a huge number of stakers would withdraw their deposited ETH. This, in turn, might affect the price of the altcoin negatively.

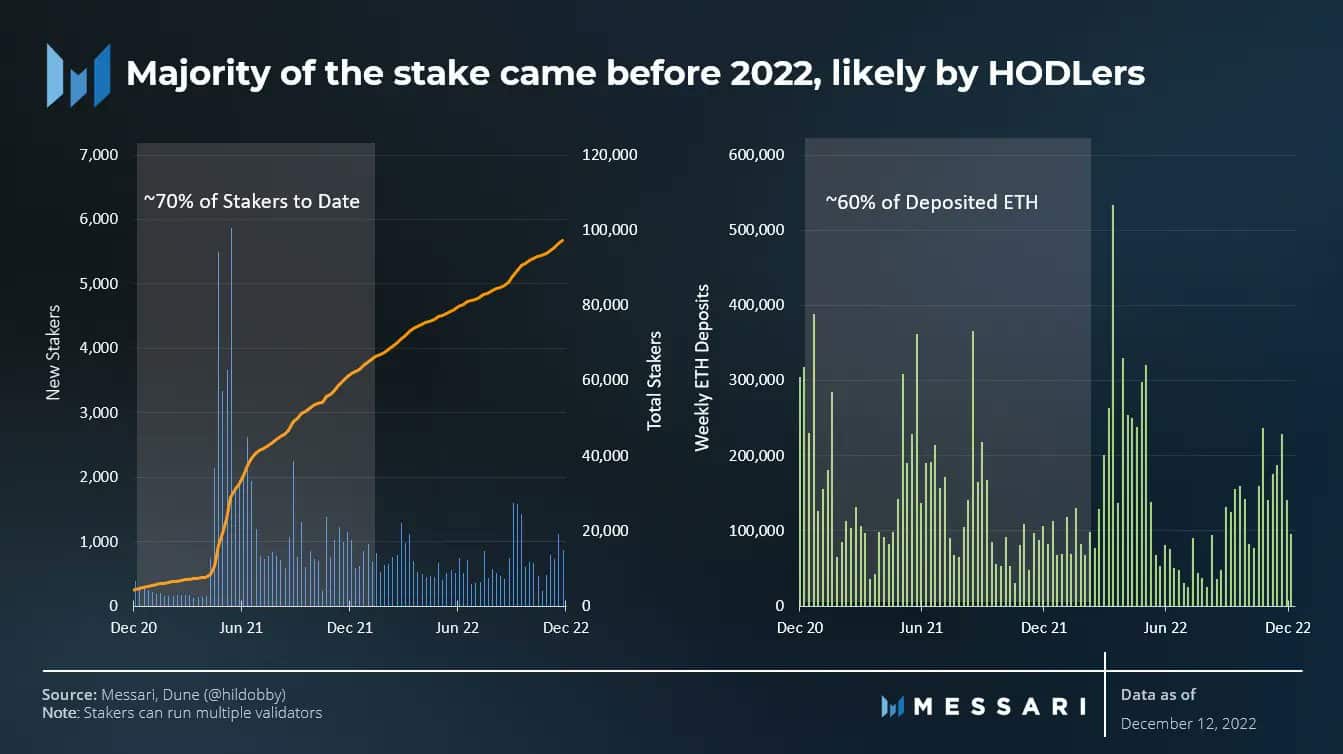

It’s important to note here that a majority of ETH’s stake came before 2022, mostly in the bull market. And, interestingly, these stakes have come from HODLers.

Despite the enabling of withdrawals, long-time HODLers of Ethereum may not withdraw their ETH anytime soon.

Source: Messari

That being said, Ethereum would also be introducing Protco Danksharding. This update would make L2 transactions exponentially cheaper. And, in turn, help scale the Ethereum network even further.

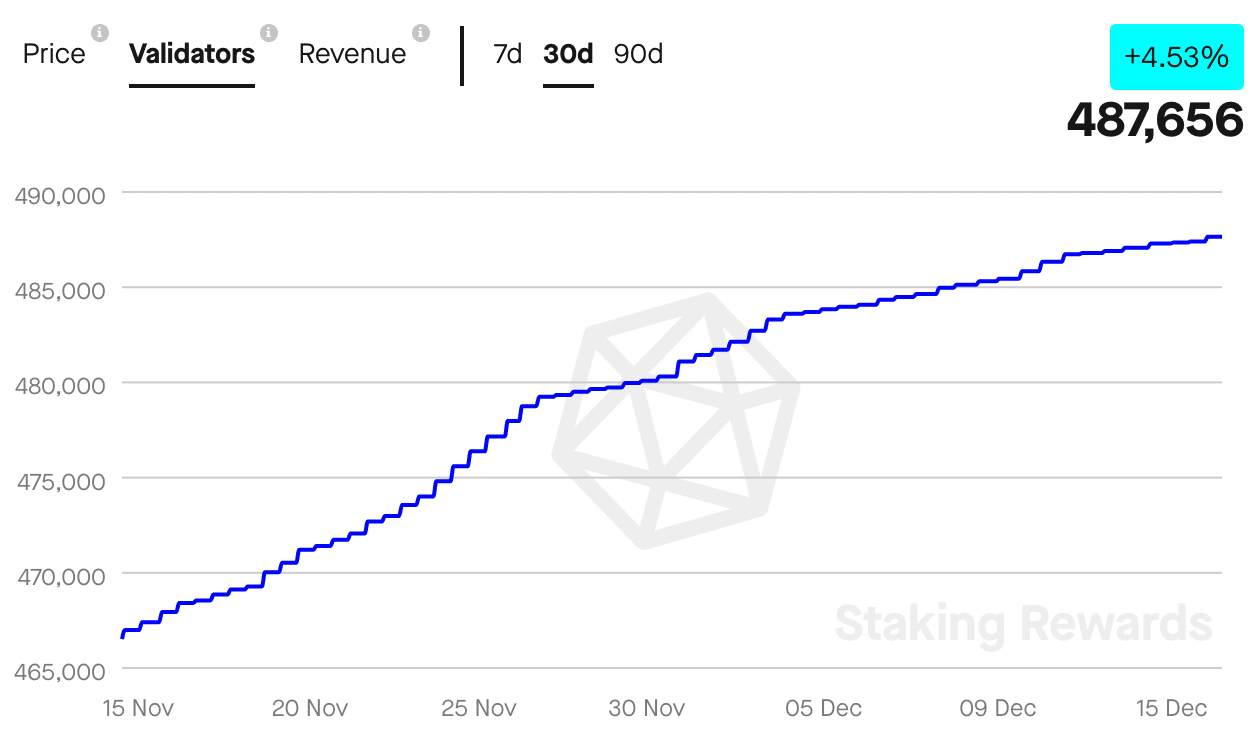

These updates may be one of the reasons why the validators on Ethereum’s network have continued to show support for Ethereum.

From the image below, it can be observed that the number of validators on the Ethereum network continued to increase. Their count grew by 4.53% in the last 30 days.

The support from the validators was shown despite their declining revenue. According to Staking Rewards, the amount of revenue generated by the validators decreased by 26% in the past month.

Source: Staking Rewards

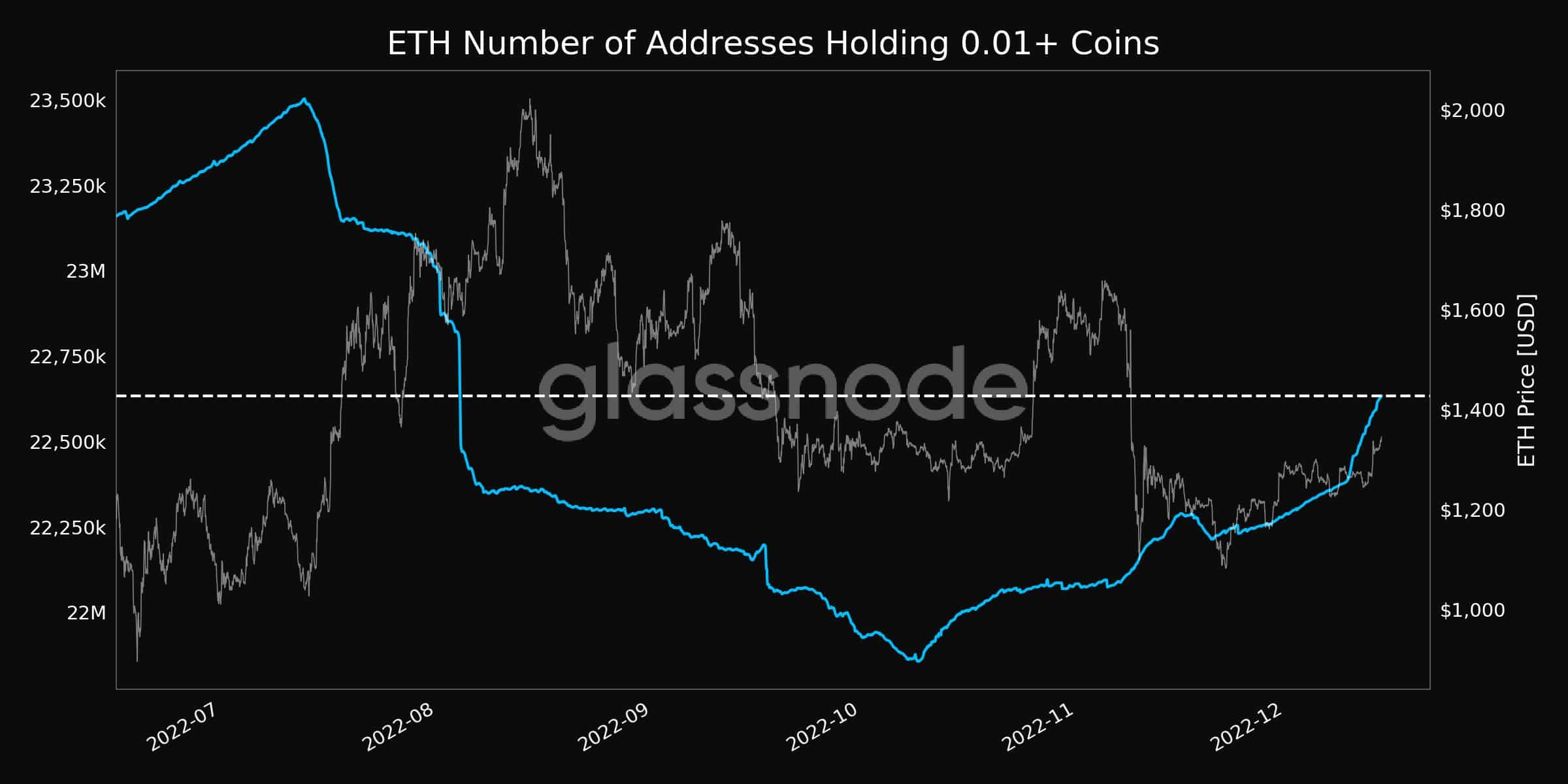

Along with the validators, retail investors showed interest in Ethereum. Consider this- the number of addresses holding more than 0.01 coins increased tremendously over the last few months.

Coupled with that, the activity on Ethereum increased too. According to data provided by glassnode, the number of transfers grew and reached a 4-month high of 24,000 transactions.

Source: glassnode

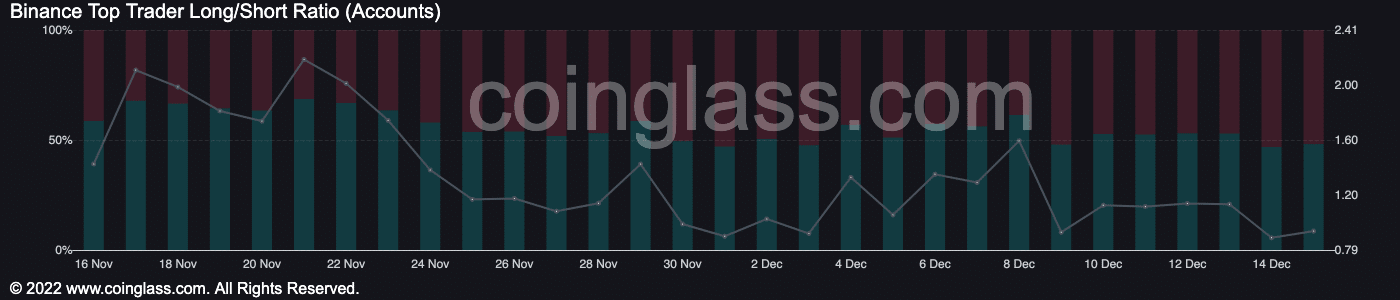

Despite these positive developments, traders’ sentiment around Ethereum remained negative.

Traders remain skeptical

Through coinglass’s data, it was observed that the number of short positions taken against Ethereum had continued to increase over the past few weeks.

At press time, 51.84% of the top traders on Binance had taken short positions against Ethereum.

Source: coinglass

However, it remains to be seen whether Ethereum can perform well in the upcoming quarter.

![What Ethereum [ETH] holders should expect in 2023 and beyond?](https://www.cryptonewsmetaverse.com/wp-content/uploads/2022/12/1668405100524-c80db575-04b1-48cd-8208-0f495de20b14-1000x600.png)