intermediate

Understanding margin calls is crucial if one wants to trade cryptocurrencies with leverage.

Cryptocurrencies are known for being high-risk, high-reward assets that can bring astronomical profits, and margin trading is a proven instrument for experts to multiply their revenue. It’s no surprise that even despite all the extra risk involved, these two have been combined to create crypto margin trading. You can engage in crypto margin trading on most exchanges and crypto trading platforms.

What Is a Margin Call in Crypto?

A margin call is a signal sent by a trading platform or a brokerage firm when the value of a trader’s margin account falls below the required amount, which is called the maintenance margin requirement.

A margin call is basically a warning for the trader that if they don’t top up their margin account or sell the asset, their position will be liquidated automatically.

Formula for the Margin Call Price

The price at which a trader may receive a margin call varies depending on what asset is being traded and the individual margin requirements of each brokerage firm or trading platform.

There are a few ways to determine at what price a margin call may be received. Some platforms openly display the price of an asset at which your account value will go below the maintenance requirement. Some also show how close you are to receiving a margin call.

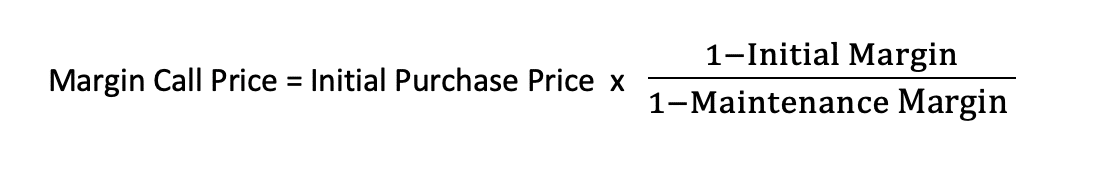

Here’s the margin call price formula:

The initial margin here refers to the leverage used in your initial trade (e.g., 50%). The maintenance margin is set individually by each broker and trading platform.

Example of a Margin Call

Here’s a simplified example of a margin call one might receive when doing crypto margin trading.

Imagine you’ve just bought some Ethereum. At the time of purchase, its overall value was $10K. Out of that sum, you only paid $1,000, and the rest was covered by borrowed money.

The maintenance margin on that platform is exactly 10%, so your account equity (the value of your account) should equal at least 10,000 × 0.1 = 1,000. But don’t forget — you also have a margin loan of $9,000. As a result, your account equity isn’t $10K — it’s actually $1K.

Now imagine that the next day, the ETH price declines, and so the market value of your account goes down to $9.5K, with your equity now being equal to $500.

At that point, the system will automatically detect that your equity is lower than the margin maintenance requirement and send out a margin call. You will be required to deposit additional cash to your account, namely $500.

If you would like to know how Ethereum price might actually behave in the future, check out our ETH price prediction.

What Triggers a Margin Call?

Margin calls can occur both when the price rises too high and when it drops too low — it all depends on the type of trading position. A margin call happens when the market value of a trader’s margin account drops below the maintenance margin requirement.

If the margin trader used leverage to buy digital assets, then they will be in danger when the price of their assets goes down. If they took out a margin loan to short sell assets instead, then they should be on the lookout when the prices start rising.

How to Avoid a Margin Call

- Do not engage in margin trading

The best way to avoid margin calls is to abstain from margin trading. This is especially important for traders who do not have enough cash to be confident in their ability to cover margin calls.

- Trade (relatively) risk-free cryptocurrencies

The second best way to avoid margin calls is to trade only the cryptocurrency that you know will not decline (or rise — if you have a short position) too rapidly in the near future. Crypto margin trading is extra dangerous because of the extreme price fluctuations present in this market. So, it can be really hard to find a digital asset that will be reliable enough to minimize the risk of getting margin calls.

- Practice with smaller sums of money first

If you understand all the risks associated with crypto margin trading, we recommend trying it out with smaller sums of money first and using less borrowed money by trading with smaller leverage.

- Use stop-loss orders

Perhaps, the best way to avoid getting margin calls is setting a stop loss right above the liquidation price. Please note that this can lead to minor losses as cryptocurrencies are volatile assets, and their prices can change quite rapidly in a short amount of time — a position that has just received a margin call may become profitable the next day. However, if you do not have enough funds to be sure you can cover multiple margin calls, or you aren’t an experienced trader yet, stop-loss orders can greatly minimize your risk of losing money and getting margin calls.

How to Cover a Margin Call

You can cover a margin call by either depositing additional capital to your margin account or selling a portion of your assets.

Can You Lose Money on Margin Calls?

It is very easy to lose money on margin calls, especially if you’re trading with big leverage. The most serious risk comes with being unable to top up your margin account when you receive a margin call. If that happens, then your assets will most likely get liquidated at their current price, which most definitely won’t be very favorable for you.

In addition to losing your position and initial deposit, you will also have to cover some extra losses when doing margin trading. Just like your profits, your losses can also be quite literally multiplied when you engage in margin trading — always be mindful of the amount of money you borrowed from the exchange.

Can You Pay Off a Margin Loan Without Selling?

There are two main ways to pay off a margin loan: by selling a portion of your assets (or all of them) or by depositing additional money into your margin trading account.

How Long Do You Have to Pay a Margin Call?

The amount of time you have to deposit additional funds to your margin account depends on what trading platform you are using. Most traditional brokerages can give users anywhere from 1 to 5 days to cover their margin debt and increase their account value. Crypto margin trading platforms, however, can rarely afford to be this lenient and often give their margin traders a much shorter period of time to cover their margin calls.

Will a Margin Call Liquidate Your Trades?

A margin call doesn’t always mean forced liquidation. However, if the asset you were trading reaches its liquidation price, and you don’t increase your account value to match the maintenance margin in time, then yes, your open positions (some or all of them) will be closed, and your assets will be liquidated.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.