beginner

Circulating supply is an important metric that gets mentioned quite often in crypto market analysis. You have probably heard stuff like “Bitcoin’s circulating supply” being said a thousand times before — but what does it mean, and how is it different from a cryptocurrency’s total supply?

Understanding Circulating Supply

Circulating supply refers to the total number of coins that are currently in circulation and are available to the public. This number can fluctuate depending on the number of new coins or tokens being minted or mined and the number that gets destroyed through burning.

Circulating supply is mainly used for calculating market capitalization. All you have to do is multiply it by the crypto asset’s current market price. It can also be used to gauge a coin’s or a token’s scarcity, although it does not always directly correlate with an asset’s price.

Wanna see more content like this? Subscribe to Changelly’s newsletter to get weekly crypto news round-ups, price predictions, and information on the latest trends directly in your inbox!

Stay on top of crypto trends

Subscribe to our newsletter to get the latest crypto news in your inbox

What Is Total Supply in Crypto?

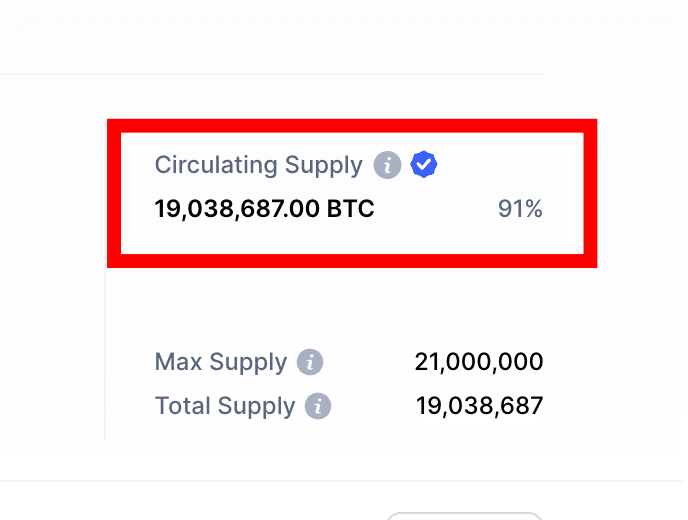

Total supply refers to the number of coins that have already been released for a particular cryptocurrency. It is a sum of the crypto asset’s circulating supply and any coins or tokens currently out of circulation. The total supply does not include coins that have been burned or otherwise destroyed.

Since currently locked up coins and tokens don’t affect the cryptocurrency’s price movement, this figure usually does not get included in any analyses or calculations of the asset’s market cap.

What Is Max Supply in Crypto?

The max supply in crypto is the total number of coins that can ever be in circulation. This number is usually set at the time of the coin’s launch and cannot be changed afterward. The max supply can give you an idea of how scarce a particular crypto asset is. For example, Bitcoin has a maximum supply of 21 million BTC, which means that there will only ever be 21 million BTC in existence, and no more coins can ever be created. This makes Bitcoin quite scarce and explains why its price is so high. Ethereum, on the other hand, has a max supply of 100 million ETH, which means that the demand for ETH is comparatively lower.

Why is the circulating supply used in determining the market capitalization instead of the total supply?

The circulating supply is the number of coins currently available for trade. The total supply is the number of coins that exist on the crypto markets at the present time but are not necessarily in circulation. It does not include coins that may be locked up or inaccessible to the public in some other way. The market capitalization is determined by the price of the coin multiplied by its circulating supply. It works this way because the market cap gives you an idea of the total value of all the coins that are currently in circulation. The circulating supply is a more accurate reflection of the number of coins that are actually being traded, so it is a better indicator of market capitalization.

FAQ

Does circulating supply matter in crypto?

The circulating supply in crypto can give you an idea of how scarce a particular asset is. The scarcer the asset is, the higher its price is likely to be.

What is the difference between total supply and maximum supply in crypto?

The total supply in crypto is the number of coins that will ever be in circulation, while the max supply is the number of coins that can ever be in circulation. The total supply is usually set at the time of the coin’s launch and cannot be changed, whereas the max supply may change depending on the protocol of the coin.

What determines the price of crypto?

The price of crypto is determined by a number of factors, including the circulating supply, total supply, maximum supply of the coin, and the demand for the coin.

How does circulating supply affect cryptocurrency?

The circulating supply in crypto can give you an idea of how scarce a particular asset is. The scarcer the asset is, the higher its price is likely to be. Ethereum, for example, has a circulating supply of over 100 million ETH, which makes it much less scarce than Bitcoin.

Does staking reduce circulating supply?

When a crypto asset is staked, it is locked up and unavailable for trade. This can reduce the circulating supply of the coin, which can, in turn, increase its price.

Why are market cap and circulating supply important?

The market cap of the coin is the price of the coin multiplied by the circulating supply. This metric is important because it gives you an idea of the total value of all the coins in circulation. The circulating supply matters because it suggests how scarce a particular asset is. The scarcer the asset is, the higher its price is likely to be.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.