beginner

There are a lot of dangers awaiting unsuspecting traders in the crypto market: scam projects, wallet thieves, cryptojackers, and so, so many more.

Wash trading is a more covert malicious activity than the ones mentioned above. Instead of stealing your money outright, it aims to confuse you and chip away your funds little by little. However, it can be just as damaging as the actual criminal acts — especially in the crypto market, which is so easy to manipulate.

What Is Wash Trading?

Wash trading is a type of market manipulation that involves a trader buying and selling a security for the purpose of artificially inflating its price. Wash trading is considered illegal in most jurisdictions.

How Does Wash Trading Work?

Wash trading typically entails a trader setting up two accounts, one to buy an asset and another to sell it. The buyer first buys the asset from the seller and then sells it back at a higher price. This creates the illusion of increased demand and thus drives up the price. The seller then does the same, creating a continuous cycle of wash trades. This activity can be done manually by traders themselves or through automated software programs.

Why Would Someone Wash Trade?

There are a few reasons why someone might engage in wash trading.

First, they may be trying to manipulate the price of a security for their own gain. For example, they may be trying to artificially inflate the price so that they can sell their own holdings at a profit.

Second, they may be doing it to create market liquidity. By buying and selling the security frequently, they make it appear more liquid than it actually is. This can attract other traders to this security, which can later be sold at a higher price. This is especially lucrative for an asset class like cryptocurrency.

Finally, wash trades can also be used to hide real trading activity from regulators or exchanges. By engaging in wash trades, traders can make it difficult for authorities to track their actual trading activity and profits. Investors can reduce their taxes by claiming losses on trades, so some of them execute wash trades to seemingly incur a loss. For that reason, the IRS made it impossible to claim losses on trades where the securities sold at a loss were reacquired within a month.

Example of a Wash Trade

Let’s imagine that there’s an Investor A who really wants to sell his 100 XMR at a profit. This cryptocurrency has a relatively low daily trading volume, so its value is not that hard to manipulate.

So, our Investor A sets up two crypto wallets, one to buy Monero and another one to sell it. Then, they go to an exchange and place a sell order at $180. As soon as the order is completed, Investor A buys their own 100 XMR back from the exchange at a higher price, like $182. After doing this a few times, their actions get noticed by other market participants. They will likely think this is a sign there’s increased interest in XMR and may decide to execute a few transactions themselves. This will inflate Monero’s price, which will lead to Investor A making the profit they intended to make.

Crypto Wash Trading

Wash trading is very common in cryptocurrency markets because numerous exchanges often list the same coins, and it can be quite challenging to track the real trading activity and prices.

For example, a trader might buy Bitcoin on one exchange at $9,000 and then sell it on another exchange at $10,000, thus creating the illusion of increased demand and driving up the price. However, in reality, the trader has simply moved their Bitcoin from one exchange to another and made a profit from the spread.

Crypto isn’t regulated, so it’s easier to become a wash trader in this market. Investors mostly only have to worry about transaction and exchange commission fees.

What is NFT Wash Trading?

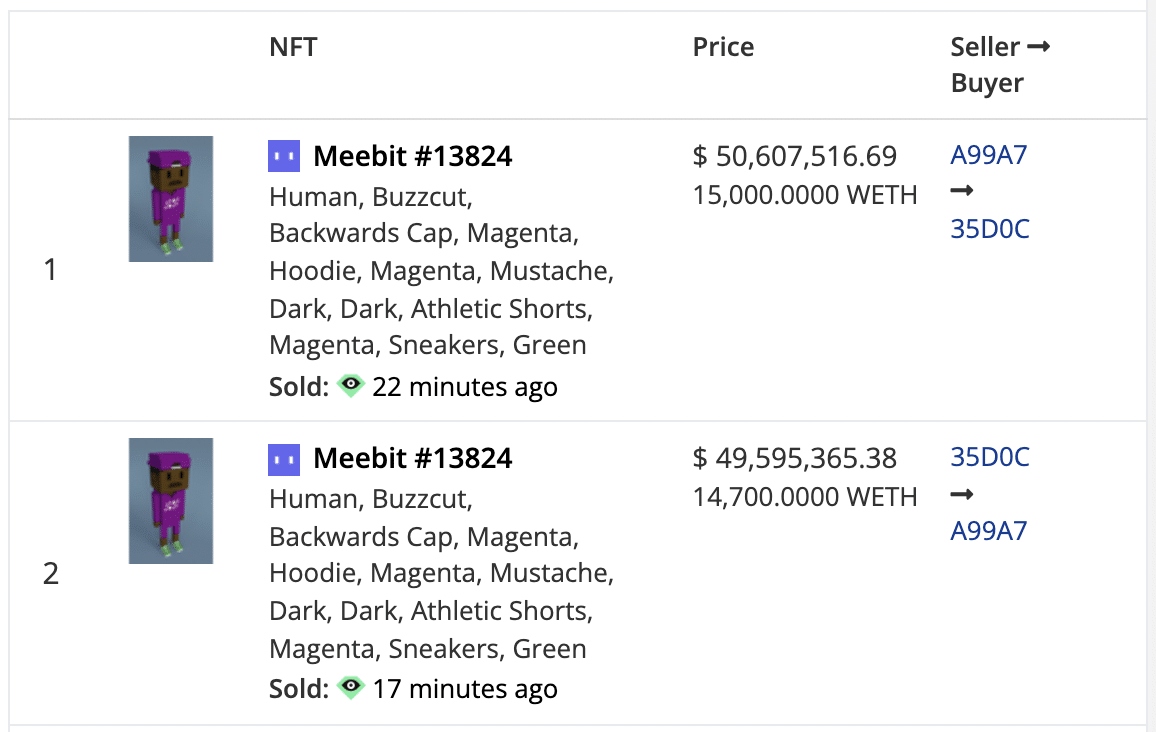

NFT wash trading is a type of trade that occurs when an investor buys and sells a non-fungible token (NFT) in order to artificially inflate its price. This activity typically takes place on marketplaces or other venues where NFTs are traded.

Wash trading is a relatively serious issue in the NFT industry. Not only does it serve to inflate prices for particular assets, it also makes the market a lot more popular than it actually is. Several studies have shown that there are a lot of non-fungible tokens that get traded 25 and more times between just a handful of wallets. And this doesn’t even account for all the purchasing done with throwaway ETH wallets that can be created for free in one minute!

How Does NFT Wash Trading Work?

NFT wash trading works the same way regular wash trading does. A trader sets up several (or a lot of) crypto wallets and uses them to buy and sell the same non-fungible token over and over again. Since the NFT market is mostly driven by user interest and hype, this works really well to drive up the values of all those assets. Not only does it increase the price of a particular NFT, it also drives up the liquidity and capitalization of the entire market. It creates artificial hype that is eventually used to attract new market participants.

Example of NFT Wash Trade

Let’s imagine that the same Investor A from our previous example now wants to make some money from NFTs. First, they purchase a newly minted non-fungible token on a marketplace. Then, they buy it from themselves for ten times the price. In the end, Investor A takes a screenshot of their profit and posts it on social media. People suffering from FOMO or those that want to make a quick buck then flock to the market, buying Investor A’s NFT or another one from that collection, thinking it’s going to be the next big thing. Of course, they end up losing money instead.

What Is the Difference between Wash Trading and Fraud?

While wash trading is a type of market manipulation, it is not necessarily fraud because wash trades are typically executed between two (or one) willing participants. Both parties know that the trade is taking place solely for the purpose of artificially inflating the price. However, if one party is unaware that it is a wash sale, then it could be considered fraud.

The Legal Aspect of Wash Trading

As wash trading is considered a form of market manipulation, it has been outlawed by most jurisdictions, regulated exchanges, brokers, and so on. In a way, wash trading is similar to insider trading: it is used to artificially inflate an asset’s liquidity and price, which increases market risk and can lead to losses for other investors interested in that asset.

In the stock market, wash trading is also often used to lower one’s taxes.

Penalties for Wash Trading

The penalties for wash trading vary depending on the jurisdiction. In the United States, wash trading is considered a form of securities fraud and can be punishable by up to 20 years in prison. In other jurisdictions, penalties may be less severe, but wash trading is still typically considered a serious offense. However, this relates only to the stock market: these penalties don’t apply to crypto.

How to Avoid Wash Trades

To avoid participating in a wash trade yourself, try to only exchange crypto on the platform or with people you can trust. Additionally, watch out for some red flags like requests to transfer a similar amount of crypto for the same price back and forth.

It’s a little bit more complicated when it comes to avoiding the consequences of wash sales and purchases executed by other market participants. You can look up if the change in the number of unique addresses used to trade that coin correlates with the increase in volume. Additionally, you can directly look through the trades executed in the past few hours or days. Since blockchains are transparent and have clear transaction history, this is a lot easier to do in the crypto market than with securities.

FAQ

What is an example of a wash trade?

A wash trade is a type of trade that occurs when an investor buys and sells a security for the purpose of artificially inflating the price. This activity typically takes place on exchanges or other venues where the security is traded. Wash sales are considered illegal in most jurisdictions.

How do you identify wash trades?

Some red flags might indicate that it was a wash trader who executed the transaction. For example, if one sees a couple of transactions with a similar price spread, trading volume, and time of execution coming in a row, this could be a wash trade.

What is a wash in day trading?

A wash in day trading is a type of market manipulation that involves an investor buying and selling a security to artificially inflate its price.

Is wash trading illegal in crypto?

Not really. Unlike traditional stock markets, where this activity and insider trading are actually illegal, crypto markets aren’t regulated.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.