beginner

Volume is an essential metric in crypto trading and investment. A high trading volume leads to fair and, usually, less volatile price changes. Low volume can cause erratic price movement and open the doors to manipulation, making it much easier to execute pump and dump schemes.

You can measure volume in a few different ways. It can refer to the total number of coins traded in a given period, the total dollar value of all trades in a given period, or the number of unique addresses used to buy or sell a particular coin.

Volume can indicate several things depending on the calculation method. Let’s take a closer look at the different types of volume you can encounter when trading cryptocurrencies!

Crypto Trading Volume Explained

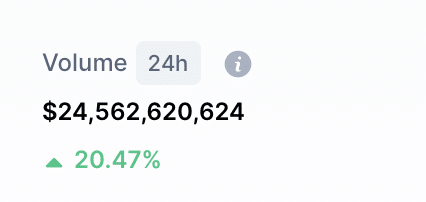

The trading volume of a cryptocurrency is measured by the number of coins or tokens traded in a given period. It is usually expressed as the number of coins traded per day. For example, if 1,000 BTC and 500 BTC are traded on two different exchanges on a particular day, the total daily volume of Bitcoin would be 1,500.

Another way to measure volume is to calculate the total dollar value of all trades in a given period. It is often expressed as the total dollar value traded per day. For example, if 1,000 BTC and 500 BTC are traded on two different exchanges for a total of $10,000 and $5,000, respectively, then the total volume of Bitcoin would be $15,000.

The number of unique addresses used to buy or sell a particular coin is another way of measuring volume. It typically measures how diverse the market for the given cryptocurrency is and can showcase whale dominance for that crypto.

Wanna see more content like this? Subscribe to Changelly’s newsletter to get weekly crypto news round-ups, price predictions, and information on the latest trends directly in your inbox!

Stay on top of crypto trends

Subscribe to our newsletter to get the latest crypto news in your inbox

Why Is Volume Important in Cryptocurrency?

Cryptocurrency volume can be a helpful indicator when it comes to determining the strength of a particular market. A large volume indicates a lot of interest in a particular coin and can signify that it is being traded actively. A small volume may indicate a lack of interest in a particular coin and that it is not being traded actively.

High demand is also measured by the number of unique addresses used to trade a coin or a token, the more the better. If the number of market participants is relatively low and whales dominate the market, it is not a good sign. If a small crypto has a significant volume of daily traded coins but a low number of unique addresses, then it could be a scam.

You can also use crypto volume to determine an asset’s price. A large volume often indicates a lot of interest in a particular coin and that we are likely to see rising prices soon. A small volume often signifies a lack of interest in a particular coin and that its price is likely to go down. Additionally, higher exchange volume also usually leads to lesser volatility in the market, as it becomes harder for a single trader to change the price direction one way or another.

Additionally, the volume of a cryptocurrency is frequently used to help determine the liquidity of a particular market. Liquidity refers to how easy it is to buy and sell a particular coin. A market with high liquidity is one where it is easy to buy and sell coins and where there is little or no price difference between various exchanges.

Volume Indicators

Various volume indicators are used in the cryptocurrency world. There’s no one “good indicator” — all of them serve their own unique purposes.

Some of the most popular volume indicators include:

- The Total Volume Traded: the total number of crypto units traded in a given period.

- The Dollar Value of All Trades: the total dollar value of all trades in a given time frame.

- The Number of Unique Addresses Used: the number of unique addresses used to buy or sell a particular coin.

- The Percentage of Total Volume Traded: the percentage of the total volume that a particular coin represents.

- The Weighted Average Trade Size: the weighted average trade size of all trades in a given time period.

- The Volume-Weighted Average Price: the volume-weighted average price of all trades in a given period.

How to Use Volume Indicators

All indicators have different purposes. They can be used to measure liquidity, help predict the future price of an asset, help weed out scams, and so on.

Some traders use volume indicators to help them make decisions about when to buy or sell a particular coin. Other traders use volume indicators to help confirm other technical analysis signals. For example, a trader might use a volume indicator to help confirm a breakout on a candlestick chart.

Some indicators can be used to predict future prices — for example, the on-balance volume (OBV), which is a momentum indicator. The on-balance volume uses changes in a coin’s trading volume to help determine whether we’re likely to see rising or falling prices in the near future.

It is important to remember that no single indicator is perfect. Volume indicators should be used in conjunction with other technical indicators.

Can Volume Be Faked in Crypto?

Yes, it is possible for volume to be faked on the crypto market. This is often done by wash trading, which is when a trader buys and sells the same coin multiple times to create the appearance of high volume. Although wash trading is illegal in many markets, it can be difficult to detect. A person or a group of people engaging in wash trading can even use a multitude of unique addresses to hide their tracks.

Some exchanges were accused of wash trading in the past. So, it is crucial to do your own research and to only trade on reputable exchanges.

Is High Volume Good?

High volume can be good because it indicates that there is a lot of interest in a particular coin. This often leads to an increase in the coin’s price.

However, it can also be “bad”. High and increasing volume does not always equal upward price movement. Bear markets tend to see increased volume due to many people rushing to sell off their assets. Nonetheless, higher interest in a coin or a token is always beneficial for traders as it brings more potential buyers and sellers.

Is Low Volume Bad?

Low volume can be bad for cryptocurrency because it indicates that there is a lack of interest in a particular coin. This often leads to a decrease in the coin’s price. However, low volume can also be good for traders since price movement will be a lot more drastic. It leads not only to higher risk but also to higher potential profit.

FAQ

How do you calculate cryptocurrency volume?

To calculate the volume of a cryptocurrency, you need to multiply the number of traded coins by the price of each trade.

What is a good volume for cryptocurrency?

There is no definitive answer to this question. Some people believe that high volume is good for cryptocurrency, while others think that low volume is better. Ultimately, it depends on your own trading strategy and what you are trying to accomplish.

How do I increase cryptocurrency volume?

If you want to increase the volume of a particular cryptocurrency, you can buy more coins or convince other people to buy more coins. You can also try to get the coin listed on more exchanges.

How does the trading volume affect crypto?

Volume can affect crypto in a few different ways. You can use it to determine the strength of a market, the liquidity of a particular coin, and its price. Volume can also be used to confirm other technical analysis signals.

What cryptocurrency has the highest trading volume?

Bitcoin is a crypto with the highest trading volume, and Ethereum is the second-largest crypto asset by trading volume.

Does volume increase a crypto’s price?

Not necessarily. High volume does often indicate higher interest in a coin and its potential increase in value, but it can also mark the beginning (or a peak) of a bear market.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.