- XRP witnessed a spike in social dominance, which could lead to a price pump

- However, sentiment against XRP remained negative

On 3 December, crypto analytics firm Santiment tweeted that Ripple’s [XRP] social dominance witnessed spikes over the last few days. This spike could result in short-term positive price action in the near future. However, the coin would be vulnerable to a quick sell-off if prices do soar.

🗣️ #XRPNetwork, #Stellar, & #Status are all currently on the top trending list in #crypto Friday. These assets are all relatively even on the day, which means pump chances are higher than usual. But watch for a quick sell-off if they do while trending. https://t.co/puOnDyvhJp pic.twitter.com/wu3k5syQLw

— Santiment (@santimentfeed) December 2, 2022

Read Ripple’s [XRP] Price Prediction 2023-2024

Another factor to consider would be XRP’s growth in social mentions, which grew by 67.1% over the last week, according to LunarCrush. Despite the spike in mentions and dominance, the sentiment against XRP remained negative.

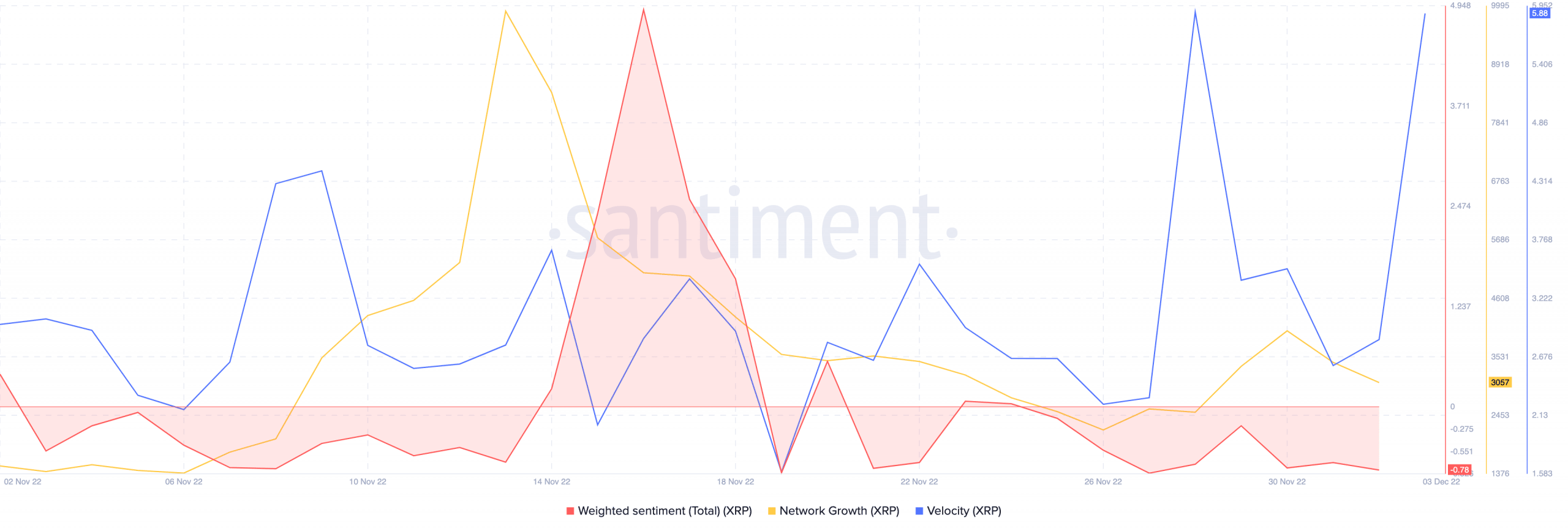

XRP’s weighted sentiment declined over the last few days as well, indicating that the crypto community’s overall outlook towards XRP was negative. Furthermore, XRP’s network growth also witnessed a massive decline. This indicated that the number of addresses transferring XRP for the first time had reduced.

However, the coin’s velocity observed a huge spike, implying that the frequency with which XRP had been moving across exchanges had increased.

Source: Santiment

XRP profits in the short term

One reason for the increase in transactions could be the growing Market Value to Realized Value (MVRV) ratio of XRP. A growing MVRV ratio indicated that, at the time of writing, if most of holders were to sell their holdings, they would take away some profit.

The declining Long/Short difference line showcased that short-term holders would profit off the trade if traders sold in this market. However, long-term holders would have to wait for a longer period to experience some gains.

Source: Santiment

At the time of writing, XRP was trading at $0.390 and. Its price had risen by 19.3% since 14 November and remained between $0.41 and $0.371 after 25 November.

The Relative Strength Index (RSI), which was at 44.13, indicated that the momentum was still with the sellers despite XRP’s momentary uptick. However, the Chaikin Money Flow (CMF) witnessed a spike and was at 0.13. Thus, the money flow indicated that there was strength in the market.

Source: TradingView